OK OTC 320-C 2021-2025 free printable template

Show details

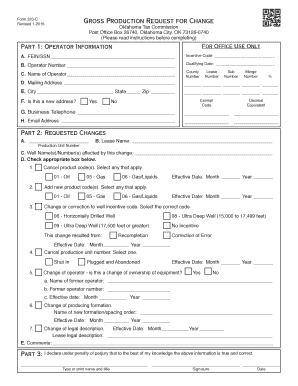

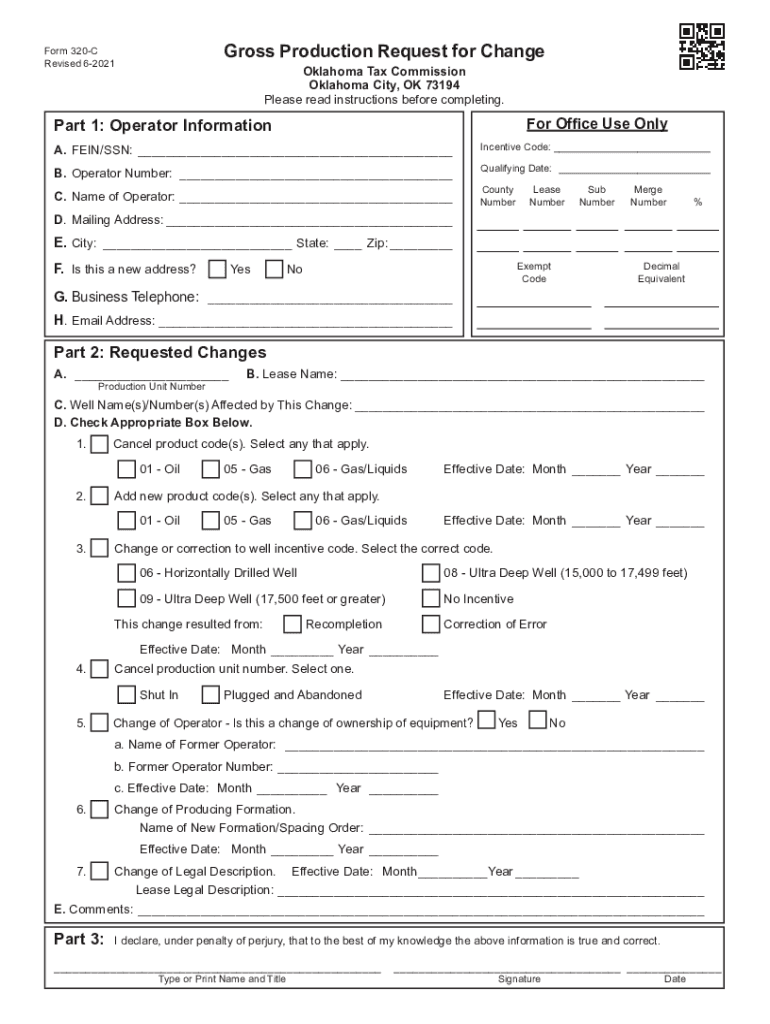

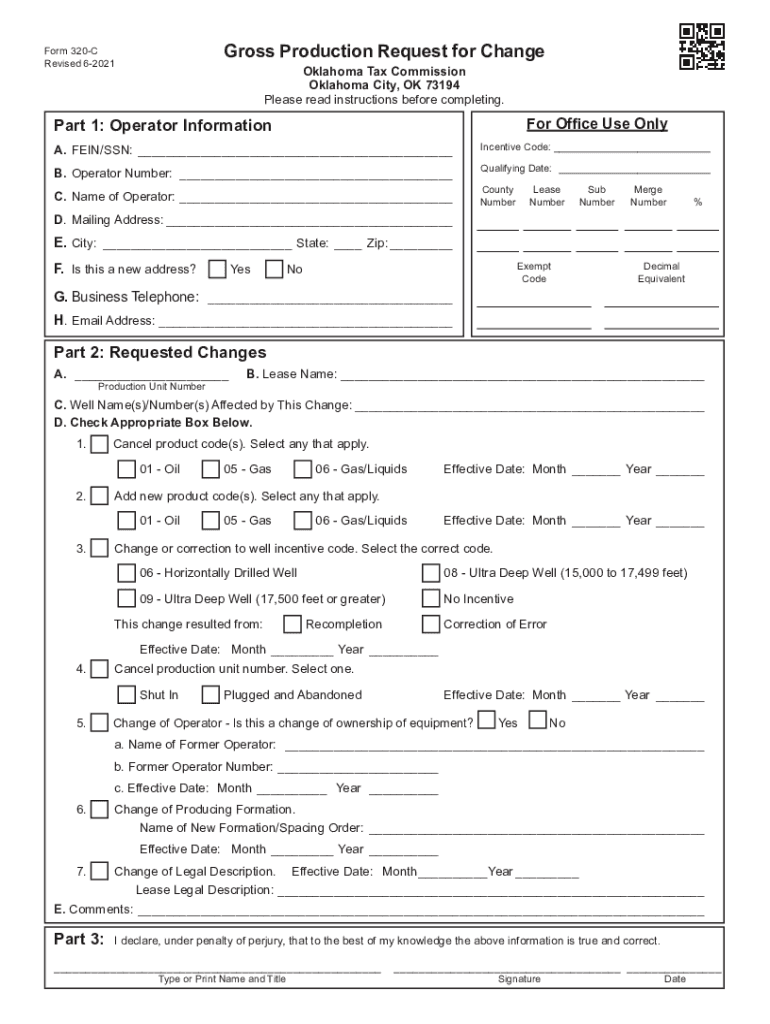

Gross Production Request for Changer 320C Revised 62021Oklahoma Tax Commission Oklahoma City, OK 73194 Please read instructions before completing. For Office Use Flypast 1: Operator Information A.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oklahoma 320 c request change form

Edit your oklahoma 320 c change form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma 320 c fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma 320 c request printable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oklahoma tax 320c change form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 320-C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oklahoma tax c request form

How to fill out OK OTC 320-C

01

Gather necessary information such as patient details, prescription details, and dosage requirements.

02

Start with the patient information section: fill in the patient's name, address, date of birth, and contact information.

03

Proceed to the prescription details: include the medication name, dosage, quantity, and instructions for use.

04

Fill in the prescriber’s information, including the name, address, phone number, and professional registration number.

05

Ensure all sections are completed accurately and double-check for any errors or omissions.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate authority or pharmacy.

Who needs OK OTC 320-C?

01

Patients who require a prescription for over-the-counter medications.

02

Healthcare providers who are prescribing OTC medication for their patients.

03

Pharmacies that need to document and process OTC medication prescriptions.

Video instructions and help with filling out and completing tax form 320 c fillable

Instructions and Help about oklahoma tax 320 c change

Fill

oklahoma form 320 request

: Try Risk Free

People Also Ask about oklahoma form gross request

What are the residency requirements for tax purposes in Oklahoma?

An Oklahoma resident is a person domiciled in this state for the entire tax year. “Domicile” is the place established as a person's true, fixed, and permanent home. It is the place you intend to return whenever you are away (as on vacation abroad, business assignment, educational leave or military assignment).

How many months do you have to live in Oklahoma to be a resident?

For many tax and legal purposes, the state of Oklahoma will consider you a resident if you spend more than 183 days or 6 months out of a 12-month period there.

Who pays Oklahoma gross production tax?

Gross production taxes are paid to the Oklahoma Tax Commission monthly by the first purchaser of the minerals, and withheld from the payment to the owner of the mineral rights.

What qualifies as residency in Oklahoma?

For purposes of the Oklahoma Self-Defense Act, the term "residency" shall apply to any person who either possesses a valid Oklahoma driver license or state photo identification card and physically maintains a residence in this state or has permanent military orders within this state and possesses a valid driver license

Who is required to file Oklahoma tax return?

ing to Oklahoma Tax Commission, if you are a resident and your gross income exceeds the amount allowed for your filing status, you must file an Oklahoma tax return. Part year residents: During your period of residency you will have the same filing requirements as a resident.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit oklahoma 320c gross request in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your oklahoma c gross fillable, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit oklahoma c gross production on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing ok 320 c printable right away.

How do I fill out 320 c request change printable using my mobile device?

Use the pdfFiller mobile app to fill out and sign ok tax 320 c fillable. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is OK OTC 320-C?

OK OTC 320-C is a specific form used for reporting certain transactions and tax obligations related to the oil and gas industry in Oklahoma.

Who is required to file OK OTC 320-C?

Entities engaged in the production, gathering, or transportation of oil and gas in Oklahoma are typically required to file OK OTC 320-C.

How to fill out OK OTC 320-C?

To fill out OK OTC 320-C, you should provide the required information accurately, including details of the transactions, and ensure that you follow the instructions provided by the Oklahoma Tax Commission.

What is the purpose of OK OTC 320-C?

The purpose of OK OTC 320-C is to collect information for tax compliance and to ensure that the state can accurately assess and collect taxes related to oil and gas operations.

What information must be reported on OK OTC 320-C?

Information that must be reported on OK OTC 320-C includes the details of oil and gas transactions, production amounts, sales data, and any applicable deductions or credits.

Fill out your tax form 320 c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ok 320 C Request Change is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.